Storm Damage Insurance Claim FAQs

The last thing you want after a storm is getting bogged down while settling a claim with your insurance provider. That’s where we can help. Rapid Roofing, one of the top roofing contractors in Michigan, can help take care of the paperwork while you get your life, business and home back on track after untimely storm damage. We answer these frequently asked questions about the insurance claim and what you can do to get started.

Are Roofing Contractors Really Necessary for Insurance Claims?

Your insurance adjuster can assess damage and determine how much compensation you’ll receive. Remember, though, that they are on the insurance provider’s side. Your roofing contractor will do a thorough assessment and ensure that all relevant points are covered for your benefit.

Should I Still File a Claim Even If I Don’t See Any Damage?

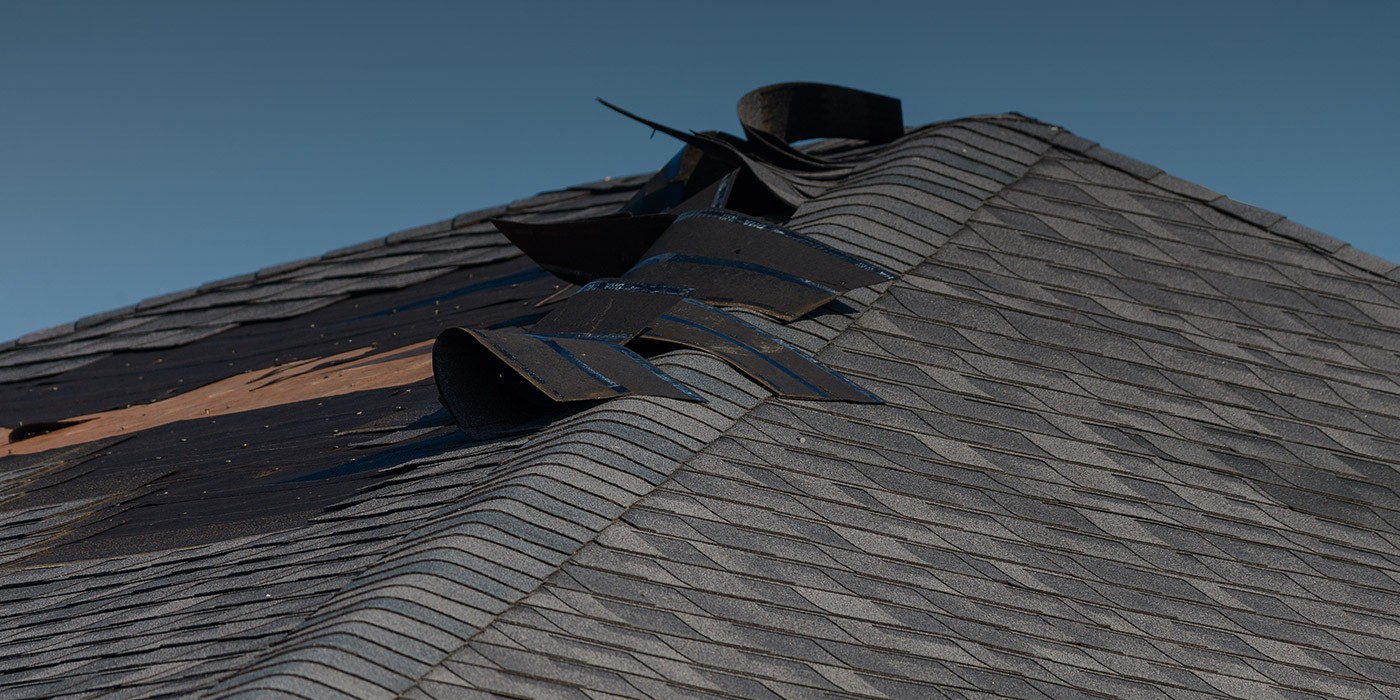

It’s true that sometimes a storm can leave your roof unharmed. However, damage can be hard to spot especially if you don’t know how and where to look. This is why it’s important to have your roof inspected to determine if there’s damage and if you need to file a claim.

How Long After a Storm Can I File My Claim?

The time you have to file after a storm depends on your insurance policy. In most cases, you can file a claim up to a year from the time of the storm. We recommend, however, contacting a contractor immediately, not only to help you with the claim, but also to have any potential damage addressed promptly.

Can a Storm Raise My Premiums?

In many policies, “acts of God” like storms do not necessarily raise premiums. This can vary from one company to another, however, so it’s best to consult your provider to discuss coverage and premiums.

From storm damage assessment and repairs to commercial or residential roof installation and everything in between, Rapid Roofing is your premier provider of all roofing and roof services. Call us today at (734) 234-5900 to schedule an appointment and get a free estimate. We serve Plymouth, MI, and nearby areas.

Residential Roofing

Residential Roofing Storm Damage

Storm Damage Multi-Family Homes

Multi-Family Homes